اصل مصنف: ایئر ڈراپ Insulator Scof, ChainCatcher

Original editor: TB, ChainCatcher

The whole story

On the evening of April 15, ZKsync token ZK experienced an abnormal decline, with a drop of more than 14% in 24 hours, and the price once fell below $0.04. After the incident, Bithumb and other exchanges suspended ZK deposit and withdrawal services.

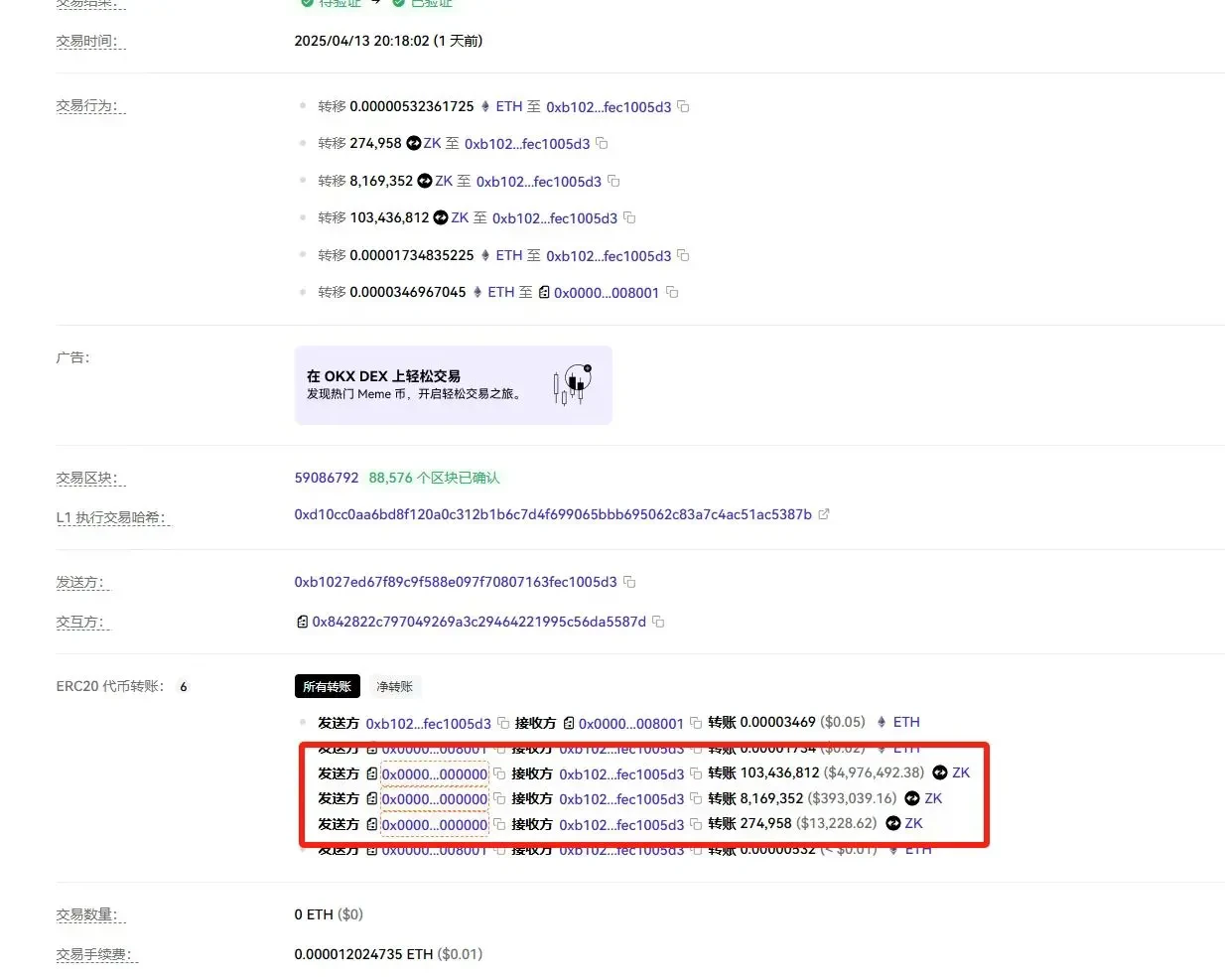

According to on-chain data, the actual attack took place at 8 pm (UTC+ 8) on April 13. The attacker used an administrator account of an airdrop distribution contract to call the sweepUnclaimed() function in the contract, from which about 111 million unclaimed airdrop tokens were minted. Subsequently, the attacker sold about 66 million of the tokens and transferred them across chains. When the incident was exposed on April 15, there were still about 44.68 million tokens left in the attackers address.

At 9 pm on April 15, the community first disclosed the abnormal issuance and selling behavior on social platforms. ZKsync officials responded later and confirmed that this was due to the leakage of the administrator keys of three airdrop distribution contracts, resulting in abnormal casting behavior. Officials said that this incident only involved airdrop contracts and did not affect the ZKsync protocol itself, the ZK token master contract, the governance contract or other token distribution plans. The circulation of tokens increased by about 0.45%, with a total value of about US$5 million.

The ZKsync team coordinated with the exchange on the night of the incident, trying to freeze the relevant funds and calling on the attacker to return the tokens to avoid legal liability. The official emphasized that the attack path can no longer be used again and the rest of the current system is not affected.

After the incident, the price of ZK tokens rebounded briefly, but has not yet recovered to the level before the incident. As of now, the investigation is still ongoing, and the project team said that further details will be released.

The former king of pop became dead?

ZKsync, Arbitrum, Optimism and Starknet, which were once listed as the Four Heavenly Kings of Ethereum Layer 2, are now moving in completely different directions. It is worth mentioning that many of my peers started to get in touch with on-chain operations by participating in the airdrops of these projects, and learned about basic concepts such as wallets, interactions, and gas fees. These projects not only carry the technical practice of Ethereum expansion, but also become the starting point for many people to enter the کرپٹو world to some extent.

ZKsync and Starknet both belong to the ZK Rollup route and were once regarded as representatives of the technical school, focusing on higher security and data validity. ZKsync uses the EVM-compatible zkEVM as a selling point, hoping to reuse Ethereum ecological tools to lower the development threshold, while Starknet insists on the self-developed Cairo language system in exchange for higher performance potential, but also limits its ecological expansion. In contrast, Arbitrum and Optimism adopt the OP Rollup solution with earlier technical implementation, relying on optimistic proofs to achieve transaction settlement, and entering the market faster in terms of development tool chain and compatibility.

In terms of ecological construction, Arbitrum is undoubtedly the strongest performing project at present. Not only have native DeFi projects such as GMX gained a firm foothold, but the overall application layer distribution is also richer. Optimisms pace is more inclined to governance and architecture expansion. It launched OP Stack and launched the Base mainnet in cooperation with Coinbase, and has initially built a modular alliance chain pattern. The ecological heat of ZKsync basically stayed before and after the airdrop. After the airdrop, many projects ran away one after another, and the confidence of users and developers was seriously damaged. Starknets development pace has always been slow, and the progress of ecological expansion has lagged behind.

In terms of user activity, Arbitrum has long been in the lead, far exceeding the other companies in terms of both on-chain active addresses and transaction volume, followed closely by Optimism. ZKsync reached a peak during the airdrop, but its activity quickly fell back, and its current daily activity has fallen to a low level. Starknets data has been stable for a long time, but its growth has been weak and it has always been difficult to break through.

The amount of locked positions on the chain can also directly show the gap between projects. According to DefiLlama data, Arbitrum ranks first in the L2 TVL list with $2.1 billion, and has a certain economic self-circulation ability; Optimism also maintains high expectations with the expansion potential of OP Stack; ZKsyncs revenue has been sluggish for a long time, and its TVL has only fluctuated at a few event nodes, lacking growth momentum for a long time; Starknet also faces the problem of insufficient scale, with relatively small revenue and locked positions.

Judging from the data of fund bridging, the gap in ecological activity of each project is also very obvious. According to Dune data, the cumulative bridging volume of Arbitrums official cross-chain bridge has exceeded 4 million ETH, ranking first among all Layer 2 projects; ZKsync is closely behind, with a total of about 3.7 million ETH. On the surface, the data is not low, but the activity has obviously declined. In the past 7 days, only 14 users used the ZKsync official bridge, and the total bridging amount was only 5 ETH, which was almost at a standstill. In contrast, the total bridging volume of Optimism and Starknet is not high, and has not yet exceeded 1 million ETH.

But it is worth noting that despite Arbitrums robust performance in the on-chain ecology, active users and continued advancement of project implementation, the price trend of its token is not ideal. From last years high of about $2.4, the price of ARB has fallen back by more than 88%, but the current market value remains above $1.3 billion. This contrast may be closely related to its continued release of circulation. Since the launch of the token, Arbitrum has unlocked large amounts of tokens many times, resulting in long-term market selling pressure and price trends under pressure.

The former Layer 2 Big Four represented the future direction of Ethereum expansion and were also the first stop for countless users. However, after experiencing technology implementation, airdrops, security incidents, and project differentiation, today鈥檚 Layer 2 track is no longer a highlight.

The high performance, low cost, and strong security that were once repeatedly emphasized now seem to be losing their appeal. How long can those narratives that use Layer 2 as the entrance last? At a time when funds and attention are constantly flowing out, is Layer 2 really a bridge to large-scale applications, or is it just a phased transition solution? Will the projects that were once highly anticipated eventually stop in the middle of technological evolution?

This article is sourced from the internet: ZK collapsed. Are the four kings of Layer2 doing well now?

Original article from The Defi Report Compiled by Odaily Planet Daily Golem ( @web3_golem ) Editors note: At the end of March, researchers at The Defi Report predicted that Bitcoin would fall below the key support level of $85,000 in April (Related reading: Bear market set, Bitcoin may fall below key support area in April ). This is indeed the case. With the introduction of Trumps tariff policy in early April, the crypto market was hit hard, and Bitcoin fell to $74,501. The Defi Report has long held the view that the market has entered a bear market, and it has concluded as early as early March this year (Related reading: The evidence is strong, we are entering a bear market ), and told investors not to buy at the…

ہائے