Seeing the essence of tariff conflicts and the driving force behind Bitcoin’s rise: It’s time to buy at the bottom

Orijinal makale şuradan alınmıştır: The Defi Report

Odaily Planet Daily Golem tarafından derlendi ( @web3_golem )

Editors note: At the end of March, researchers at The Defi Report predicted that Bitcoin would fall below the key support level of $85,000 in April (Related reading: Bear market set, Bitcoin may fall below key support area in April ). This is indeed the case. With the introduction of Trumps tariff policy in early April, the kripto market was hit hard, and Bitcoin fell to $74,501. The Defi Report has long held the view that the market has entered a bear market, and it has concluded as early as early March this year (Related reading: The evidence is strong, we are entering a bear market ), and told investors not to buy at the bottom easily.

But after Trumps tariff policy caused market turmoil, The Defi Report decisively bought the bottom of Bitcoin at $77,000, and believed that the markets liquidity conditions were improving. We are experiencing a once-in-a-century structural change in world trade and global markets. The tariff and trade tensions between China and the United States will bring buying to Bitcoin.

In the following report, The Defi Report analyzes from a macro perspective that the world is currently in the fourth period of change. The US tariff policy is always aimed at China, and explains why the trade game between China and the US is conducive to the rise of risky assets such as Bitcoin. Odaily Planet Daily compiled the full text as follows, enjoy~

The Changing World Order

Everyone is focused on tariffs right now. But let’s not lose sight of the bigger picture: We are in the midst of the “Fourth Turning” (which only happens about every 80 years).

If you’re not familiar with the Fourth Turning, authors Neil Howe and William Strauss kesinliklene it as a period of upheaval and reconstruction that occurs approximately every 80-90 years. During a Fourth Turning, society enters an existential crisis, often catalyzed by war, revolution, and other upheavals, during which old institutions are destroyed or fundamentally reshaped in response to perceived threats.

The Fourth Turning tends to coincide with the end of a long-term debt cycle (which we are also experiencing now). This is the winter of historical cycles, which will bring about huge changes in all aspects of our lives, such as social and political upheaval, the reshaping of the global monetary system, economic and technological disruption, cultural and moral resets, and geopolitical upheavals.

In a way, the Fourth Turning represents a reset of society—a time of destruction and rebirth. Historical examples include the American Revolution (1775), the Civil War (1861), and the Great Depression/World War II (1939). At the same time, the end of the Fourth Turning will also catalyze positive changes and consolidate a new social order.

Look at the world today, how divided the US is, inequality (class struggle, social war), the collapse of US and global institutions, the spread of populism, geopolitical conflicts, the rise of Bitcoin and artificial intelligence, etc. These are all evidence that we are experiencing the Fourth Turning.

Trump is a byproduct of all this, and he fits perfectly into the “Fourth Turning” because during this period, voters tend to elect “strongman” leaders to deal with the challenges of the day.

Only with the right perspective can we clearly see what is happening today. If we don’t study history, we have no reference point to understand what we are going through. So, in this context, do Trump’s tariff policy work?

Do tariffs really work?

These tariffs don’t make any sense on the surface, and of course the Trump administration will defend them in the media as bringing manufacturing back to the U.S., being fairer to Americans, and strengthening the middle class.

But some of these points are indeed correct. Over the past few decades, as manufacturing has moved to China, the American middle class has suffered greatly. But this still does not explain the significance of Liberation Day, because Liberation Day itself has no meaning. Because everyone understands that free markets work better than markets distorted by government intervention. (Odaily Note: Trump announced a series of new trade policies with reciprocal tariffs as the main means in a speech in the Rose Garden of the White House on April 2, 2025, and named this day Liberation Day.)

The United States wants to use tariffs to force other countries to target China

We analyzed the tariffs Trump imposed on China during his first term, hoping to find some clues to explain it all. As a result, we found a key clue, which led us to conclude that the tariffs imposed on other countries on Liberation Day were intended to put pressure on China.

When the United States increased tariffs on Chinese goods in 2018-2019, China actively redirected exports to other markets and third world countries. Instead of losing sales, Chinese companies found alternative buyers. For example, Chinas exports to the EU and ASEAN countries (Cambodia, Malaysia, Singapore, Thailand, Vietnam) increased, compensating for the loss of exports to the United States. By early 2020, Chinas exports to the EU ($580 billion) exceeded its exports to the United States ($440 billion), a trend that began to accelerate after the initial US tariffs on China in 2018-2019.

Many Chinese manufacturers also circumvent U.S. tariffs by transshipping products through neighboring countries. A Harvard Business School study found that Vietnam captured nearly half of China’s U.S. import market share between 2017 and 2022 (growing from $42 billion to $109 billion), while Vietnam’s imports from China also climbed—suggesting that Chinese products are being transshipped to the U.S. through Vietnam, with similar trends seen in Taiwan and Mexico.

In short, Chinese goods can reach the United States indirectly. In fact, according to Chinese statistics, China s exports to the United States have hardly declined , while the US data shows a sharp decline. Both sides have their own opinions.

But it also shows that the import gap of more than $150 billion means that a large number of Chinese exports have been diverted or mislabeled. Who are the biggest beneficiaries? Obviously, Vietnam, Malaysia, Cambodia, Thailand, Mexico and Europe.

Interestingly, these are the countries hardest hit after the tariffs were imposed on April 2: Cambodia (49%), Vietnam (46%), Thailand (36%) and the European Union (20%).

Now it all makes sense. We believe that Trump is not really trying to gain revenue by imposing tariffs on these countries, but rather wants to use tariffs as leverage to drive them into a corner. Trumps goal is to incentivize them to shut out Chinese products through negotiations. In return, we speculate that he may offer to reduce tariffs on them, increase trade with the United States, and provide security guarantees.

Mexico and Canada may have agreed to exclude Chinese products from their markets because neither country was on the Liberation Day list.

But to be clear, this is only our conclusion after studying the past tariffs the United States has imposed on China and questioning its motivation to impose reciprocal tariffs on all other countries. Our goal is to find trading signals in all the rhetoric, and we believe this is still a showdown between the United States and China.

As Charlie Munger once said, “Tell me the incentives and I can predict the outcomes.” The United States has an incentive to impose tariffs on Vietnam (and other countries) in order to force them to exclude China from their markets and shift supply chains away from China.

Whats next for tariffs?

U.S. Treasury Secretary Scott Besant, who may be the main architect of the plan (and the man who persuaded Trump to suspend tariffs for 90 days to save the markets), is the man who helped bring down the Bank of England and is now trying to bring China to its knees.

Bessant may have seen an opportunity to radically change the US trade deficit with China, and he has a deep understanding of the levers behind it all. For example, the Peoples Bank of China absorbs dollars from exports and uses these dollars to stabilize the RMB exchange rate (to make exports cheaper). There may also be a larger game behind this, which is about the changing world order.

Then, the next step for the US government must be negotiation, and the Trump team will seek to negotiate with all countries except China.

In terms of market conditions, although the crypto market rebounded after the announcement of the 90-day tariff suspension order, the magnitude was weaker than that of stocks, and we still regard this as a bear market rebound. It is common to see a correction of about 50% after a sharp sell-off. If the SP index maintains 5,550 points and the Nasdaq index maintains 17,600 points, we will re-evaluate.

We know that China is still the biggest factor in this game. But Trump does not want to negotiate with China. He wants to win the support of other countries on the Liberation Day list and then work hard to shift the supply chain away from China. This is more like a power struggle and has nothing to do with tariffs and fairness.

If the United States reaches an agreement with countries such as Vietnam to shut China out, then China may also adopt corresponding macroeconomic policies to fight back. The market may subsequently view the agreements reached between the United States and various countries as positive, but Chinas countermeasures will sober the market, because the market will gradually realize that a trade war will trigger a capital war and may even trigger a hot war.

Although there is a 90-day cooling-off period, there is no solution that will allow investors and businesses to plan for the future with more confidence, and the situation is getting worse as Trump has again increased China tariffs to 145%. As revealed by a senior Forbes reporter, the Trump administration may delist Chinese listed companies from US exchanges.

Bitcoin may rise amid tariff war

But looking ahead, Bitcoins fundamentals are improving. We have recently invested about 15% of our funds in Bitcoin (average cost price $77,000) and hold a small amount of TI (average cost price $2.34) as a long-term holding.

Although there are still many uncertainties, why do we choose to buy the dip at this time? Given the following signals, we believe that liquidity conditions are improving:

-

The inflation rate is 1.4% (according to Truflation data);

-

Economic growth is slowing. We think tariffs will accelerate that process, and the Atlanta Fed is forecasting a 2.4% contraction in GDP in the first quarter.

Data: Atlanta Fed

-

The increased probability of a recession is high (perhaps more than 50%).

-

The U.S. Treasury needs to refinance $2.5 trillion of debt and issue another $2 trillion (to cover the deficit) by the end of the year, with more to come in 2026.

-

The US dollar index has fallen sharply (below $100).

Additionally, China has begun stimulating its economy and we think there will be more stimulus to come. As the yuan comes under pressure, we think Bitcoin will get some buying (just like it did in 2015 when China devalued the yuan and in 2019 during the escalation of the trade war).

But even so, we would still lean toward caution given Bitcoin’s volatility and close correlation to the stock market, tariffs, and the lack of certainty regarding Chinese policy.

In terms of momentum indicators, Bitcoin’s 50-day moving average fell below the 200-day moving average last week (a “death cross”) and is currently trading below the all-important 200-day moving average at $85,000. If Bitcoin falls below the previous high ($70,000), the bear market will last longer, so caution is warranted.

However, as this situation develops, we are also beginning to see signs of seller “exhaustion”. The figure below shows how Bitcoin performed after the “death cross”.

It’s also important to note that while Bitcoin should do well in a more stagflationary environment if the Fed begins to ease and bond yields rise again, the challenge is that the same may not be true for stocks (and altcoins), which could be a headwind to Bitcoin’s upside in the short term given its correlation to the Nasdaq and other risk assets.

Çözüm

We believe that it is prudent to look at the big picture. We are in the early stages of a “once-in-a-century moment of great change”, so we need to be fully prepared. The possibilities we need to deal with next are as follows:

-

China’s participation in the negotiations;

-

Trump backed off;

-

The situation could change quickly if the U.S. Supreme Court intervenes to block or reduce the tariffs.

The real intention of the United States is to exclude Chinese goods from the global market. It is not clear whether this strategy will work, but tensions may escalate further. Trumps aggressive style works in many cases, but it may fail this time because he cannot coerce the bond market. The more pressure he puts on China, the greater the resistance from the bond market.

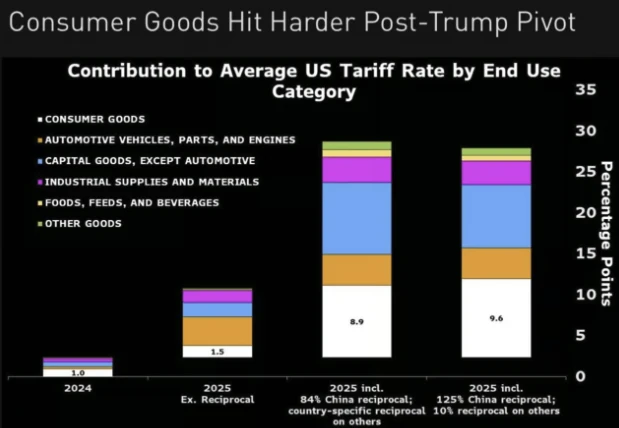

Despite the 90-day suspension of tariffs, the market still has no long-term solution. Moreover, given that the US has 145% tariffs on China, the revised tariff package (10% on other products) is actually more harmful to consumers than the tariff package implemented on April 2 (due to the increase in imports from China).

Source: Bloomberg Economics, Anna Wong

If tensions between major powers escalate and economic conditions continue to deteriorate, we expect market prices to fall further and the Federal Reserve to adopt quantitative easing (or send out quantitative easing signals). This will become a key catalyst for investors to actively allocate risk assets such as Bitcoin.

Of course, as always, we will update our views as the situation develops.

This article is sourced from the internet: Seeing the essence of tariff conflicts and the driving force behind Bitcoin’s rise: It’s time to buy at the bottom

Related: How to play the upgraded version of Pump.fun, Super.exchange?

The market has suffered from insider traders for a long time. This is probably the lament of every degen that has been harvested by the President Coin and the Wife Coin. After finally enduring the leek market and the rug market, yesterdays waterfall washed the face and made the market sentiment fud again. At this time, No LP, no insider information. We will save the bear market! – a project called Super.exchange hit the pain point with a super hero-like rescue declaration, which quickly attracted attention in the community. What is the magic of this new asset issuance platform in the Solana ecosystem? Upgraded version of Pump.fun Why are meme insider information frequent, sniping constant, and pool withdrawal common? In Super.exchange’s view, a large part of the problem is that…