XRP has been attempting to recover from a significant 25% decline, which saw its price drop from $3.00 to $2.33. While investors are hopeful for a rebound soon, the path to recovery may take some time.

This delay could also result in potential losses for traders who are caught in the ongoing market fluctuations.

XRP Traders May Face Potential Liquidations

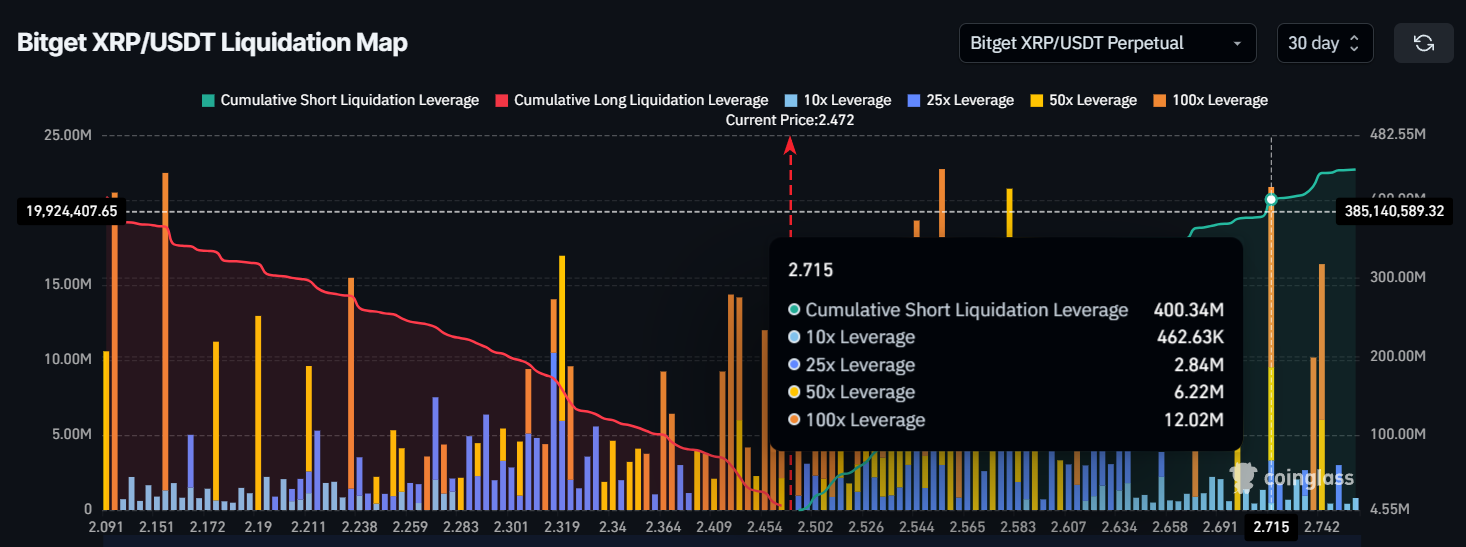

The liquidation map for XRP reveals a concerning scenario for short sellers. Approximately $400 million worth of short contracts are placed between the current price and the $2.70 mark. This significant volume of short positions shows that traders are betting against XRP’s price movement, reflecting a dominant skepticism in the market.

A mere 10% price increase could lead to the liquidation of these short positions, potentially causing a swift price movement to the upside. However, the large number of short contracts in place highlights the market’s overall cautious sentiment, which could delay the recovery or result in further volatility if the price fails to breach key resistance levels.

The macro momentum for XRP is still dominated by bearish signals, with the Average Directional Index (ADX) sitting at 35.0, well above the 25.0 threshold. This suggests that the strength of the downtrend remains intact, even after the recent 25% price crash. The ADX reflects ongoing momentum in the market, indicating that XRP is still under pressure despite its attempts at recovery.

Should the ADX rise further, it would signal that the bearish trend is still strong, potentially creating resistance in XRP’s recovery efforts. As long as the ADX remains high, it could limit the effectiveness of any upward price movement and cause delays in regaining previous levels.

XRP Price Prediction: Awaiting A Breach

Currently, XRP’s price is at $2.47, just 10% away from the next major resistance at $2.70. The altcoin is moving within an ascending wedge pattern, suggesting that the next move could likely be a rise. If XRP manages to break through the $2.70 resistance, it could see further gains.

However, the factors mentioned above indicate that this rise may face significant resistance. XRP may struggle to breach the $2.70 barrier, or it could remain closer to the support level of $2.33 if selling pressure prevails. In this case, the price could consolidate within a tight range or experience further drawdowns.

If bullish market cues begin to overpower the prevailing bearishness, XRP could successfully breach the $2.70 resistance. A break above this level would turn it into support, potentially invalidating the bearish outlook and setting the stage for a more sustainable recovery in the coming days.

.aff-primary {

display: none;

}

.aff-secondary {

display: block;

}

.aff-ternary {

display: none;

}

Wirex

สำรวจ

YouHodler

สำรวจ

eToro

สำรวจ

Phemex

สำรวจ

BingX

สำรวจ

Wirex

สำรวจ

YouHodler

สำรวจ

eToro

สำรวจ

Phemex

สำรวจ

BingX

สำรวจ

Wirex

Wirex

YouHodler

YouHodler

eToro

eToro

Phemex

Phemex

BingX

BingX

“If you’ve lost money fraudulently to any company, broker, or account manager and want to retrieve it, contact www.Bsbforensic.com They helped me recover my funds!”